Robotics Process Automation to automate Accounting/Finance

Robotics Process Automation (RPA) technology holds immense potential to outrun complex challenges faced by businesses and enterprises involved in the repetitive tasks and procedures currently handled manually. The integration of Artificial Intelligence (AI) in RPA to act according to inducted change in the regular process makes it even more productive and robust for any business. The emerging industries which are considering this technology as a boon in their processing are health, retail, bank, account, and finance. RPA automation solutions in any sector are always fruitful if the actual process stage is identified with prior analysis and on which Robotic Process Automation implementation does not bring any significant change to the other levels of the processing.

RPA in finance and accounting is revolutionary and includes no bar in raising the business’s productivity and efficiency. There is a large scope of shifting from tedious, repetitive, and mundane human tasks to quick and efficient automated processes in the respective sectors. Steady business profits are attainable by setting pre-defined logical parameters (based on the ideal structural process) to be analyzed by the Robotic Process Automation solution for data analysis and decision making automatically. This automation eliminates the chances of process breakage, prioritization, fraud, and lack of efficiency in manual processing.

Why banking and Accounting investing in RPA tools?

Financial management system including banking and accounting was devoid of automation technology for a long time and most of the processes were executed by humans only who used to work on some kind of processes continuously resulting in erroneous processes, incomplete tasks, forgotten steps, and high utilization of time as well as efforts. Many insincere employees got a good chance of performing cheats or frauds in accounting and payments due to the unavailability of financial tracking software and RPA solutions in banking.

But the scenarios are changing. According to a report by Gartner, more than 70 percent of financial businesses have deployed RPA in financial firms. With many advantages of Robotic Process Automation in banking and accounting such as streamlining processes, nil error, cost cut down, reduction in complexity, and more, many analytics think it is a great way to stand steady in the growing competitive market. Any integrated financial management system which has deployed Robotics Process Automation software as one of the financial management solutions can deal with many high-volume and repetitive manual tasks like invoice processing, tax management, receivables management, Financial statement closing, reporting, supplier onboarding, regulatory compliance, inventory management task, etc. automatically based on the process parameters and algorithms on which it is designed to work.

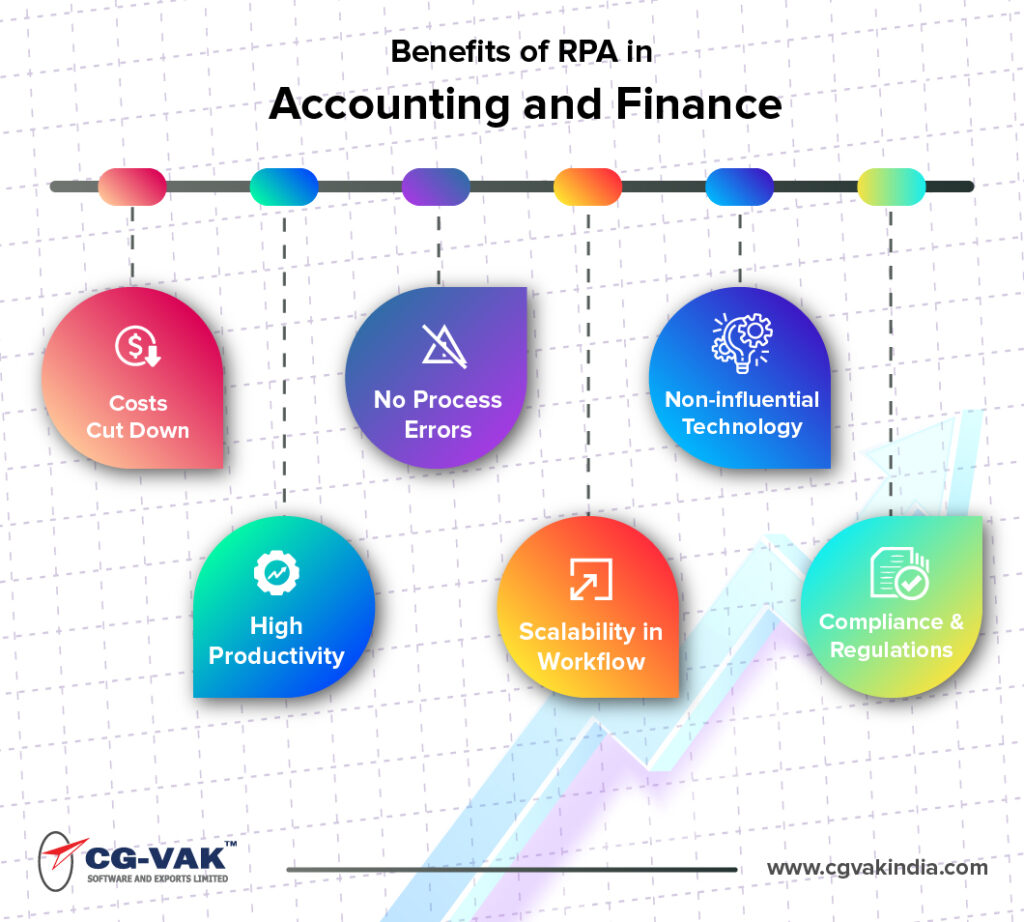

Benefits of RPA in Accounting and Finance

With RPA Robotic Process Automation software deployment, financial organizations have managed to become a strong compliance regulator and big output provider in a short time and thrive to achieve more in coming years. Get a brief knowledge about the main benefits of Robotic Process Automation technology in the Accounting and Finance sectors.

1. Costs Cut Down:

Introducing Robotic Process Automation for Accounting and Finance eliminates the requirement of manpower and back-office resources which ultimately cut down the related costs and also free up employees for another business requirement than repetitive, high volume tasks.

2. High Productivity:

In place of working for a definite working shift by humans, the quick and 24*7, non-stop processing by RPA automation solutions, for example – invoice processing, financial statement closing, etc. helps in increasing business productivity like never before while managing the clients’ reputation as well.

3. No Process Errors:

Tasks automation in finance/accounting processes like tax management and supplier onboarding brings reduced rate or nil error as workflow pattern is pre-decided and meant to produce consistently accurate results.

4. Scalability in Workflow:

RPA technology is easy to implement and modify for certain sections of accounting and financial services as required by the business management thus providing a customizable workflow to manage certain financial services simultaneously.

5. Non-influential Technology:

While deciding to deploy Robotic Process Automation software in any industry, a crucial analysis on the automated accounting software development based on the process and workflow is performed keeping it completely ineffective to the existing framework or structure of the organization making it a fully non-invasive technology.

6. Compliance & Regulations:

RPA in Accounts and Finance is crucial to maintain regulatory and compliance standards based on the strict software process automation and set parameters to be followed by everyone to maintain the business security.

Know about real-time use cases of RPA in finance and accounting

Apart from the automation of regular manual tasks of accounting and management in the financial organizations, the real-time use cases of RPA as enterprise financial management software interest a lot. Let us understand some common picked up examples.

1. In Accounts Payable & Receivable

A huge sense of process accuracy and performance in Accounts Payable with automated payments, workflow, data entry, approvals, vendor management, and more; order processing, credit approvals in Receivable with RPA applications.

2. In Insurance Claim/Loans Processing

Having implemented smart RPA software for loan or insurance claim processing, the accuracy and efficiency have increased which helped a lot in saving unproductive time and efforts of applicants who were following the old traditional processing system.

3. In Detecting Forgery

Implementation of RPA solutions for cybersecurity in financial institutions can reduce the risk of online thefts (money processing), accounts hacking or identity forging to a very low level and keep updated the organization of any foreign intruder with financial tracking software.

4. In Credit Card Management

Credit Card management after the issue is a challenging task as its loss can create a drill in the customer security which now can be capably managed by automated RPA solutions to record each cardholder’s personal and verification details to ensure its real master and facilitates to block it away for malicious persons.

5. In Data Entry

Maintaining the accounts record of a bunch of customers based on their investments and processing is now an easy task with RPA software solutions eliminating heavy work of both front and back-office operators.

RPA- Your best solution for Accounting and financial business process

For secure, streamlined, cost-effective, customizable, and high-performance Accounting and financial business processes, the RPA platform is the best. It would be a great decision for any business to migrate accounting with RPA to enhance business performance and reap soaring profits. It is a transformational technology for financial and accounting businesses by automating complex, repetitive tasks performed manually to deliver a high rate of accuracy and low rate of risks and errors.

Summary

Robotic Process Automation is an incredible automated technology that is a potential lawbreaker in Accounting and Finance industry is discussed along with its high-end benefits and real-time examples.

CG-VAK is the trusted custom software development company and one of the best Robotic Process Automation companies in India. It delivers both onshore and offshore services excelling in the field of Robotic Automation platform. Contact us sharing your project details.